Paying young people is a way of acknowledging that they are professionals. It shows you value and respect young people’s time and contribution to your projects and opportunities.

Payment acknowledges the potential consequences that some young people face as a result of participating in opportunities such as missing a shift at work, and recognises the emotional labour of sharing lived experience.

It also breaks down some of the power dynamics that exist between organisations and young people.

Remuneration refers to payment for a professional service or contribution.

Some examples of remuneration include: a regular salary or wage, an hourly rate for casual work, a fee for service for freelance work (sometimes known as independent contractor work), and an An honorarium is an honorary payment made to someone who works without obligation (i.e., a volunteer, not under contract). It recognises their professional service that was given voluntarily.honorarium for voluntary service.

Remuneration can be made in different forms: cash is most common, but it could be in non-cash form, such as gift cards, or occasionally other non-cash forms. It is important to offer remuneration in the form that is most useful and appropriate for the young person at the time.

When we talk about remuneration, we are not talking about reimbursement for expenses – that is completely separate. We do recommend that young people are reimbursed for any expenses they incur that are directly related to working on your project.

Remuneration is still a new idea that is being discussed amongst those who work with and engage young people.

There is not yet a consistent approach to remuneration, so policies vary between different organisations, local councils, and various levels of government. You should always adhere to your organisation’s policies.

As the peak body for the youth sector in Victoria, YACVic believes that youth organisations should aim to remunerate young people as much as possible, whether it’s through employing young people as staff who receive a regular wage or salary, or through paying young people honorarium payments for short term or infrequent contributions to a project or variety of projects.1

The type of payment that you will provide may be different depending on if the young person’s participation is on an on-going basis (such as a Co-design is a practice that brings people with lived experience into a design process.co-design project) or if it’s just a one-time or short-term contribution (such as participating in a A consultation is usually a workshop, survey or interview that asks for people's opinions and/or lived experience.consultation or focus group).

The Victorian government has released a guidance on payment, reimbursement and recognition for government departments and projects working with people with lived experience, which includes young people.

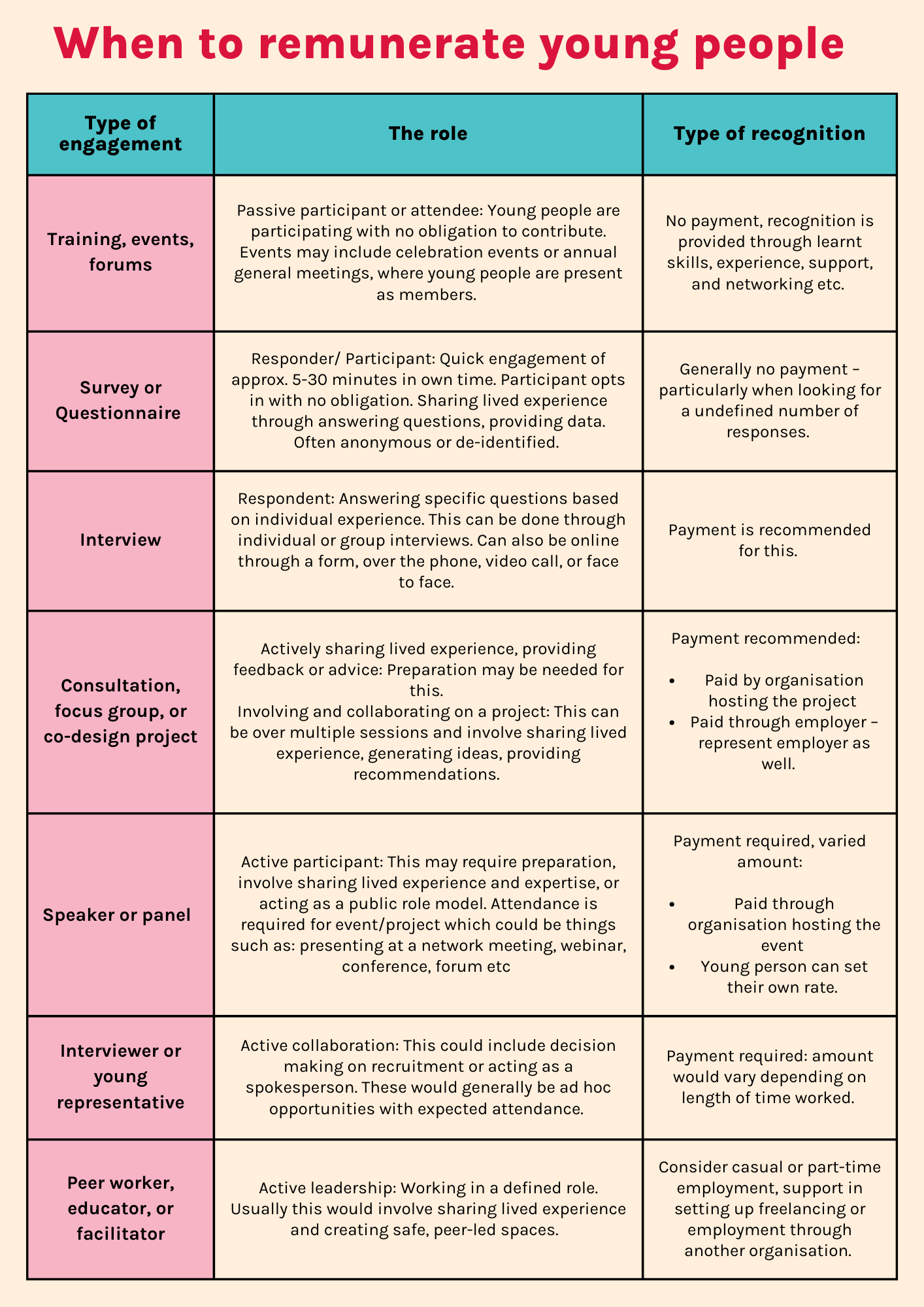

Here is a table that YACVic uses when considering remuneration, showing examples of situations where remuneration is recommended.

When to remunerate young people

Type of engagement:

Training, events, forums

- The role: Passive participant or attendee: Young people are participating with no obligation to contribute. Events may include celebration events or annual general meetings, where young people are present as members.

- Type of recognition: No payment, recognition is provided through learnt skills, experience, support, and networking etc.

Survey or Questionnaire

- The role: Responder/ Participant: Quick engagement of approx. 5-30 minutes in own time. Participant opts in with no obligation. Sharing lived experience through answering questions, providing data. Often anonymous or de-identified.

- Type of recognition: Generally no payment – particularly when looking for a undefined number of responses.

Interview

- The role: Respondent: Answering specific questions based on individual experience. This can be done through individual or group interviews. Can also be online through a form, over the phone, video call, or face to face.

- Type of recognition: Payment is recommended for this.

Consultation, focus group, or co-design project

- The role: Actively sharing lived experience, providing feedback or advice: Preparation may be needed for this. Involving and collaborating on a project: This can be over multiple sessions and involve sharing lived experience, generating ideas, providing recommendations.

- Type of recognition: Payment recommended:

- Paid by organisation hosting the project

- Paid through employer – represent employer as well.

Speaker or panel

- The role: Active participant: This may require preparation, involve sharing lived experience and expertise, or acting as a public role model. Attendance is required for event/project which could be things such as: presenting at a network meeting, webinar, conference, forum etc

- Type of recognition: Payment required, varied amount:

- Paid through organisation hosting the event

- Young person can set their own rate.

Interviewer or young representative

- The role: Active collaboration: This could include decision making on recruitment or acting as a spokesperson. These would generally be ad hoc opportunities with expected attendance.

- Types of recognition: Payment required: amount would vary depending on length of time worked.

Peer worker, educator, or facilitator

- The role: Active leadership: Working in a defined role. Usually this would involve sharing lived experience and creating safe, peer-led spaces.

- Type of recognition: Consider casual or part-time employment, support in setting up freelancing or employment through another organisation.

When deciding on the amount to pay young people, consider:

- Will the young person be missing out on their regular paid work to participate?

- Will participating mean they risk losing their casual employment where they might be expected to be on-call?

- What’s the emotional labour and cost of sharing lived experience?

- What are you offering to others in similar positions? For example, are you offering speaker fees at a conference?

Young people provide unique insight that cannot be replicated. To show appreciation and respect for young people’s time it could be helpful to begin by reflecting on these factors together with the wage paid to casual employees to determine a suitable payment for a young person’s contribution.

You may be asked by young people whether payments to them will impact on their Centrelink payments, or whether they count as taxable income.

The assessment of an individual’s income for Centrelink payments and for tax can be complex. The name or description of the payment does not determine its treatment – it depends on the nature of the payment and the volunteer’s circumstances. The situation will depend on the nature of each form of work that the individual does.2

You will need to instruct young people to include remuneration on their tax return.3 All assessable income needs to be included. Non-assessable income does not need to be included.

You also need to instruct young people to declare all remuneration when claiming Centrelink payments.

The following information is general guidance only – we cannot and do not give Centrelink or tax advice. If advice is needed, YACVic recommends discussing this with a financial advisor or directing the young person to Centrelink or the ATO website.

The ATO groups income sources into different categories. Two of the main categories that apply to young people are:

- Assessable (taxable)

- Non-assessable (non-taxable)

The ATO simple tax calculator could be helpful.

Centrelink usually groups income sources the same way as the ATO, but sometimes it groups things differently.

Assessable income

Generally, any receipts that are earned, expected, relied upon and have an element of periodicity, recurrence or regularity are treated as assessable income. At times, this could include honorarium payments.2

The following items are generally included as assessable income by both the ATO and Centrelink:4

- Regular salary or wages

- Casual wages

- Fees earned as a freelancer or independent contractor

- Tips and other payments received for their services

- Honorariums where the honorarium is given for services connected to their income-producing activities (see examples below).

Non-assessable income

If the young person’s involvement with your organisation is viewed as voluntary and a pastime or hobby – rather than income producing – money and other benefits received from those activities are generally not counted as assessable income.2

A payment to a young person that is not assessable income will have many of the following characteristics:

- The payment has no connection to the young person’s income-producing activities or services.

- The payment is not received as a consequence of employment.

- The payment is not relied upon or expected by the young person for day-to-day living.

- The payment is not legally required or expected.

- There is no legal obligation on the part of your organisation to make the payment.

- The payment is a token amount compared to the services provided or expenses incurred by the young person. (Whether the payment is token depends on the full facts surrounding the payment and the person's circumstances.

A special note about honorarium payments

Honorariums and other volunteer payments are generally not regarded as assessable income by Centrelink and the ATO; however there are some circumstances where they would be considered assessable. Below are two examples, adapted from the ATO website.1

Example: Honorarium – non-assessable income

Tal (he/him) is a 17-year-old student with a casual job at his local supermarket. He occasionally volunteers as an interviewer for his local city council when they are recruiting new staff. This year, he volunteered on three interview panels. He attended training and prep meetings, read through applications, and participated in the interview days. Tal is offered an honorarium of $300 per interview day. The honorarium is non-assessable income as Tal will be receiving an honorary reward for voluntary services.

Example: Honorarium – assessable income

Sofie (she/they) has a graphic design business and volunteers at her local youth service. Sofie designs some illustrations for a new report the youth service has been working on using her business’s software and equipment. Sofie is offered an honorarium of $300 in appreciation of their services. This honorarium will be assessable income to Sofie because it’s a reward for services connected to her income-producing activities.

Reimbursement refers to expenses incurred during employment or a participation opportunity that are covered by the organisation you are working with.5 This should be discussed clearly with the young person before the expense is made, and you should provide a clear outline of what you will and will not cover.

Some common examples of expenses that are reimbursed may include: travel, accommodation, meals, childcare and training costs.

To be reimbursed, you will need to instruct the young person to hold onto receipts and tax invoices as evidence that they spent their money on these things. The young person will be required to provide this evidence to be reimbursed.

Reimbursements are not considered assessable income and should not impact Centrelink payments and do not need to be declared in the young person’s tax return.6

Remuneration and reimbursement are complicated topics so here is a summary of the most important terms and definitions to help you out.

Remuneration

Money paid for work or service.

Reimbursement

Precise compensation, in part or full, for an expense already incurred, even if the expense has not yet been paid.

Allowances

A definite, predetermined amount to cover an estimated expense. It is paid even if the volunteer does not spend the full amount.7

Honorarium

An honorarium is either:

- an honorary reward for voluntary services, or

- a fee for professional services voluntarily performed.

An honorarium may be paid in money or in other forms (e.g. gift card).1

Youth participation

The practice of meaningfully involving young people in decision-making processes.

Lived experience

Someone with direct or personal experience of something or as a family member or carer who has experience supporting someone.

Supplier

Someone who has provided a service.

Volunteer

The ATO states that “Although there is no legal definition of 'volunteer' for tax purposes, a volunteer does not work under a contractual obligation for remuneration and would not be an employee or independent contractor. So, if any of your workers are not employees or independent contractors, they will be volunteers”.8

ABN

An Australian Business Number (ABN) is a unique 11-digit identifier issued by the Australian Business Register (ABR) which is operated by the Australian Taxation Office (ATO). The law requires each entity that carries on a business in Australia has an ABN and that the ABN appear on each tax invoice and other tax related documents issued by the entity.9

Statement by a supplier (SBS) form

Certain suppliers are not required to quote an ABN to a payer. In these cases, the suppliers can use the SBS form.

Some places to access legal advice for young people:

- Search ‘honorariums’ or ‘paying volunteers’ at ATO

- Justice Connect

- Search for ‘financial counselling’ under ‘our services’ at Anglicare

- Youthlaw

- Search ‘legal help’ at West Justice

- Australian Government, Australian Business Register. (16 November 2023). ABN entitlement. https://www.abr.gov.au/business-super-funds-charities/applying-abn/abn-entitlement

- Australian Taxation Office. (12 December 2017). Paying volunteers. Australian Government. https://www.ato.gov.au/businesses-and-organisations/not-for-profit-organisations/types-of-not-for-profit-workers/not-for-profit-volunteers/paying-volunteers

- Australian Taxation Office. (n.d). Your tax return. https://www.ato.gov.au/individuals-and-families/your-tax-return

- Australian Taxation Office. (n.d). Income and allowances. https://www.ato.gov.au/individuals-and-families/income-deductions-offsets-and-records/in-detail/occupation-and-industry-specific-guides/r-z/travel-agent-employees-income-and-work-related-deductions/income-and-allowances#ato-Reimbursements

- Australian Taxation Office. (26 April 2023). Taxable, assessable and exempt income. Australian Government. https://www.ato.gov.au/individuals-and-families/income-deductions-offsets-and-records/income-you-must-declare/taxable-assessable-and-exempt-income

- Australian Taxation Office. (12 December 2017). Honorariums. Australian Government. https://www.ato.gov.au/businesses-and-organisations/not-for-profit-organisations/types-of-not-for-profit-workers/not-for-profit-volunteers/paying-volunteers/honorariums

- Australian Taxation Office. (15 June 2022). Not-for-profit volunteers. Australian Government. https://www.ato.gov.au/businesses-and-organisations/not-for-profit-organisations/types-of-not-for-profit-workers/not-for-profit-volunteers

- Australian Government, Australian Business Register. (16 November 2023). ABN entitlement. https://www.abr.gov.au/business-super-funds-charities/applying-abn/abn-entitlement

Related Topics

YACVic is not able to provide legal or tax advice and this information should be read as general and non-specific.